Monday Briefing: SKP, Hermès, Coach Signal Renewed Optimism in China

By

Wenzhuo Wu

Published on

May 12, 2025

Start your week with sharp analysis and fresh insights into China’s latest cultural, luxury, and consumer trends. Monday Briefing connects the dots between local shifts and global repercussions, highlighting relevance to the luxury market, business strategies, and modern lifestyle trends shaping our world today.

The week following the May Day holiday brought a wave of noteworthy developments across China’s fashion and luxury landscape. The Chinese Olympic Committee named Li Ning its official sportswear partner for the 2025–2028 cycle, marking a welcoming milestone for the homegrown brand. In the footwear sector, Steve Madden entered a joint venture with Glamear Trading Limited to expand the Steve Madden and Dolce Vita brands across Greater China.

Meanwhile, Boyu Capital’s planned acquisition of a hefty stake in SKP Beijing made headlines in the luxury retail world. Hermès unveiled two upcoming in-person activations, and Tapestry’s strong Q3 earnings, fueled by Coach’s double-digit growth, offered a glimmer of hope in the struggling global premium segment.

SKP: Capital Flows, but the Culture Stays

Boyu Capital’s upcoming acquisition of a 42 to 45 percent stake in SKP Beijing is notable: a heavyweight private equity firm backing what is arguably the most successful luxury retail destination in the world. SKP Beijing has long surpassed Harrods and Galeries Lafayette in sales, reporting record-breaking figures in 2023, followed by a short dip in 2024 and a rebound in early 2025.

Critically, Boyu is coming in as a financial investor. Control remains with Radiance Investment Holdings, and operations will continue untouched. The move signals that institutional capital sees continued long-term upside in SKP’s model—particularly its ability to engage China’s luxury consumers on more than just price or product.

SKP-S, the sci-fi-inspired, experiential offshoot, is central to this thesis. With its surreal, Instagrammable installations and high-fashion-meets-art positioning, SKP-S (located at the same intersection as SKP in Beijing’s Central Business District)has emerged as more than a mere shopping mall, with cultural destination that attracts digitally native Gen Z consumers and avant-garde brands alike. The format encourages repeat visits and thrives on limited drops and curation—a blueprint increasingly mimicked but rarely matched.

As China’s wealth engine decelerates from its pre-COVID pace, physical retail must now work harder to be more than transactional. SKP isn’t selling square meters—it’s selling immersion. Institutional capital is buying into that vision.

Hermès Doubles Down on Cultural Intimacy

Meanwhile, Hermès continues to prove that luxury in China is not just about footprint—it’s about finesse.

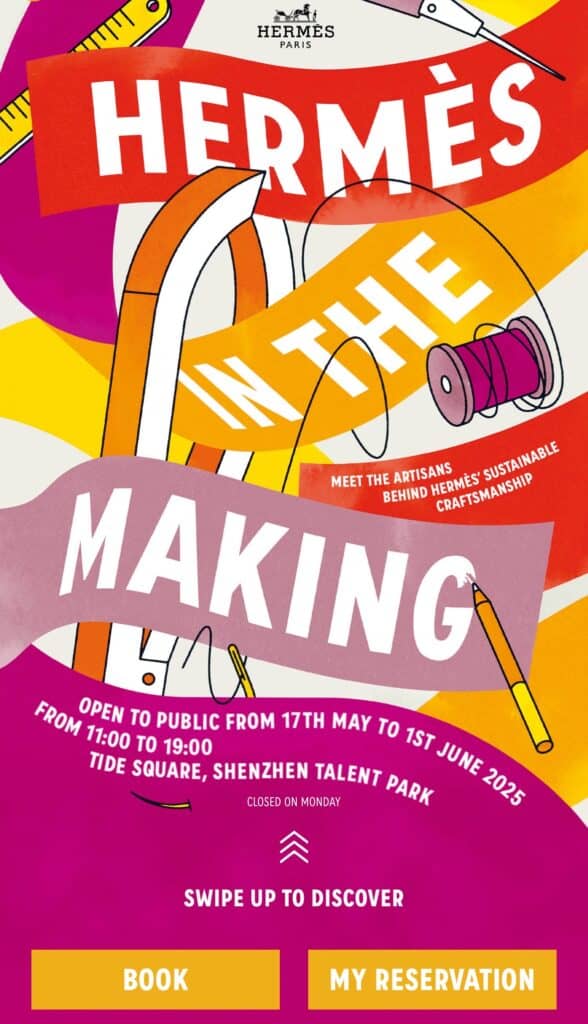

The maison announced two significant initiatives: a presentation of its Fall/Winter 2025 womenswear collection in Shanghai on June 13, followed by the “Hermès In the Making” traveling exhibition in Shenzhen from May 17 to June 1. The latter, which introduces Chinese audiences to the brand’s artisans and craftsmanship philosophy, will be staged in the Shenzhen Talent Park—a location symbolically tied to China’s innovation narrative.

This dual-city approach is telling. Shanghai remains a cultural capital, suitable for fashion spectacles. But Shenzhen—China’s tech hub and a rising creative nucleus—is where the brand chose to debut its global sustainability exhibition in in the country. It’s a quiet nod to where Hermès sees long-term growth: not only in Tier-1 shopping powerhouses, but also in younger cities with consumers aligned with its values.

In a market where consumers are increasingly discerning, Hermès is building intimacy—slowly, methodically, and with cultural fluency.

Coach Carries Tapestry’s Weight in Greater China

If the upper echelons of luxury are experimenting with art and artisanship, then premium brands like Coach are proving that accessibility doesn’t mean irrelevance.

Tapestry’s third-quarter earnings came in well above expectations, with Coach revenue surging 15 percent year-on-year to $1.3 billion, offsetting double-digit declines at Kate Spade and Stuart Weitzman. In Greater China, sales rose 5 percent to $278.9 million, compared to a regional average of 4 percent. Coach’s momentum is notable in a market where many foreign labels have struggled to recapture pre-pandemic highs.

CEO Joanne Crevoiserat credited the success to “the power of brand building” and “connections with consumers around the world.” But behind those words lies a sharper execution strategy: Coach’s repositioning in China over the past two years—defined by discount-heavy tactics to storytelling-led retail and celebrity-driven campaigns—has paid off.

Moreover, its growth comes even as some competitors retreat from lower-tier cities or close underperforming locations. Coach’s ability to localize—not just in language or platform, but in emotional tone—has contributed to its ability to regain consumer trust at a time when Gen Z buyers seek both aesthetic value and affordability in one package.

The Bottom Line

None of these headlines in isolation scream exuberance. But they don’t signal decline either. Instead, they point to a recalibrated China, where growth is no longer fast and furious, but thoughtful and intentional.

Whether it’s SKP redefining physical retail as cultural theater, Hermès stitching its brand narrative into the country’sregional fabric, or Coach gaining ground with emotional accessibility, one thing is clear: China’s luxury market isn’t shrinking—it’s shifting.

Those who thrive will be those who read the emotional temperature of the consumer as well as they do quarterly earnings.