Silver Generation, Golden Opportunity: How China’s Aging Consumers are Redefining the Market

By

Wenzhuo Wu

Published on

January 30, 2025

China’s rapidly growing elderly population is reshaping the consumer landscape, driving demand across unexpected categories. Beyond traditional sectors like healthcare and retirement services, industries such as travel, fitness, beauty, and wellness are reaping the rewards of this silver wave.

A recent study by Black Ant Capital, “The Blue Ocean of New Consumption Power: Trends in the Needs of the Vibrant Silver-Haired Population,” uncovers how this demographic—defined as individuals aged 50 to 65—is evolving into a dynamic and lucrative consumer group.

The report, based on in-depth interviews with 18 individuals from first- and emerging first-tier cities, alongside 1,000 quantitative surveys, highlights a group that is not only redefining what aging looks like in modern China but is also carving out new opportunities for brands across industries.

Jingzhi Chronicle summarized key takeaways from the report to navigate the promising consumer segment.

Rewriting Traditional Retirement Narratives

The 50 to 65 age group, characterized by its high life satisfaction and expanding digital fluency, has emerged as a consumption powerhouse. The group’s growing comfort with short video platforms and e-commerce tools has unlocked access to a broader range of lifestyle categories, transforming how they engage with products and brands.

Unlike previous generations, this group is rewriting traditional retirement narratives. Many embrace personal pensions as a means of self-indulgence rather than saving for posterity. Attitudes toward caregiving and eldercare reflect a shift: younger segments (ages 50–54) show less willingness to take on grandchild-rearing responsibilities, while affluent or younger silver consumers increasingly consider modern nursing homes as viable options—a marked departure from traditional Chinese norms.

This new silver demographic also values autonomy and social engagement. With ample free time, they actively pursue hobbies, from square dancing and karaoke to photography and fishing. Many spend hours on their smartphones, exploring short videos, financial tools, and local lifestyle platforms that introduce them to new products and experiences.

Yet not all is rosy: Some experience loneliness or a diminished sense of purpose after retirement, which, subsequently influences their spending patterns. These emotional drivers present opportunities for brands to craft products and experiences that resonate deeply with this group’s desire for connection and fulfillment.

Spending Power with a Twist

China’s silver generation approaches spending with an unexpected flair. While traditional frugality still informs their financial decisions, this group increasingly prioritizes quality, value, and personal satisfaction over saving for its own sake. Consumption behaviors driven by a “treat yourself” mentality favor products and experiences that improve quality of life.

Black Ant Capital’s research identifies three tiers of brand consumption among this group, with “quality assurance” at the foundation. Brand trust is critical, as these consumers use well-known labels to simplify decision-making and avoid risks associated with untested products. Recommendations from children, friends, or trusted platforms heavily influence their buying choices, highlighting the importance of multi-generational marketing strategies. Once trust is established, this demographic is fiercely loyal, making it a key audience for brands looking to secure long-term customer relationships.

Travel, Wellness, and Beauty: The New Essentials

Retirement doesn’t mean slowing down for this generation—it means exploring new horizons. Travel is a top priority, often undertaken with a spouse or social circle. Local lifestyle platforms have become essential for planning getaways and discovering new experiences, while social gatherings and shared interests remain integral to their daily lives.

The group’s focus on wellness and self-care is equally strong. While many rate their health as good, chronic conditions like hypertension, osteoporosis, and sleep issues are common concerns. Rather than relying on reactive medical treatments, they emphasize preventive care and long-term health management. This is often guided by the demographic’s millennial children, whose health-conscious lifestyles inspire their parents to invest in premium health supplements and products.

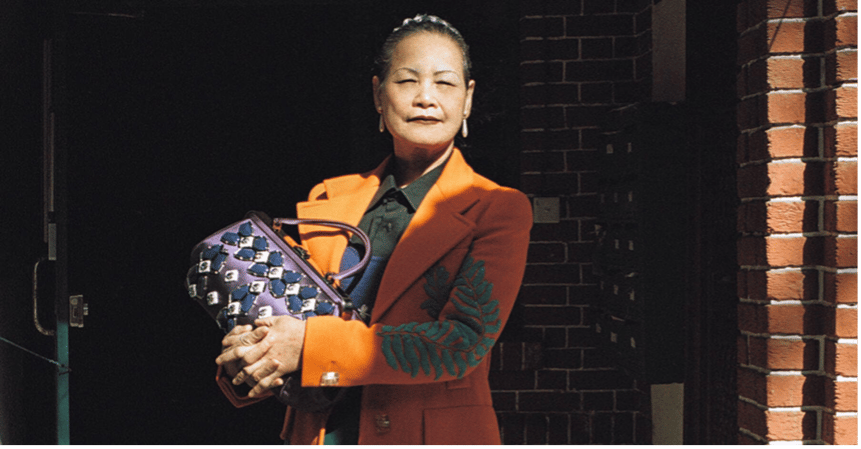

Beauty and self-presentation also play a key role in their consumption habits. Silver-haired women are driving demand for anti-aging skincare, with preferences varying by income level but consistently leaning toward products that deliver results. They seek clothing and footwear that balance elegance with functionality, favoring renowned brands that meet their desire for comfort, quality, and style.

A Golden Opportunity for Brands

China’s silver consumers are rewriting the rules of aging, blending tradition with modern aspirations. They are not just a market segment but a cultural force that challenges brands to innovate and deliver products that resonate with their evolving values.

This demographic represents a vast, untapped opportunity from travel and wellness to beauty and lifestyle. For brands ready to listen and adapt, the silver generation could be the gold standard for future growth in China’s rapidly transforming consumer market.