Value, Emotion, and Heritage: Key Trends Shaping China’s Consumer Behavior in 2024

By

Wenzhuo Wu

Published on

January 28, 2025

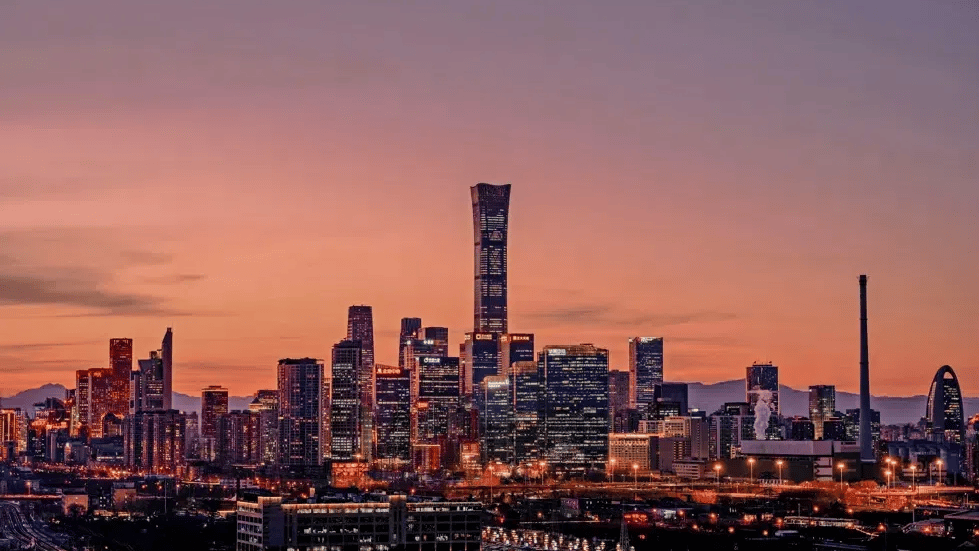

Hope, turbulence, uncertainty, and challenges—these words captured the narrative of 2024 in China.

Looking back at 2024, China’s GDP grew by an impressive 5.3 percent in Q1, 4.7 percent in Q2, and 4.6 percent in Q3, averaging 4.8 percent for the first three quarters and reaching 94.97 trillion RMB. Retail sales of consumer goods hit 44.27 trillion RMB from January to November, up 3.5 percent year-on-year. To boost consumption, several provinces and cities issued vouchers to stimulate demand. While the effectiveness of these initiatives remains to be seen, key indicators of consumer activity have shown signs of recovery.

According to the National Bureau of Statistics, Q4 saw a rebound in the stock market and slight stabilization in the long-depressed real estate sector. For two consecutive months (October and November), the net signed area of new home sales recorded both year-on-year and month-on-month growth. In October, the consumer confidence index reversed its six-month decline, marking its first uptick.

The macroeconomic and societal shifts underway are deeply affecting individuals. From international relations to viral variety shows, public discourse in China evolves rapidly, shaped by entrenched online echo chambers and stark generational and regional differences. China’s “silver generation,” raised in an era of upward mobility, boasts strong financial standing and a positive outlook. Meanwhile, younger netizens are navigating life’s challenges with humor and levity, using “abstract” self-expression as a coping mechanism.

Consumer confidence varies significantly across demographics. The 2024 McKinsey China Consumer Report reveals considerable differences in confidence levels among millennials (born 1980–1995) in different cities, with some lower-tier cities even surpassing 80 percent. Middle- and upper-income groups in these cities exhibit particularly optimistic consumer sentiment, driven by lower housing costs and more stable incomes compared to top-tier cities.

Though full-year economic data has yet to be released, emerging patterns and public data point to several transformative trends reshaping consumption for the present and the coming year. These trends will profoundly impact industry strategies and market players alike.

Value for Money

With consumer confidence at historic lows, Chinese consumers are exercising greater caution in their spending. A survey conducted by JD Research in October, which analyzed 2024 consumption buzzwords based on search frequency and online discussions, highlighted “affordable yet quality alternatives” and “trade-in programs” as top keywords. These terms underscore a growing focus on the balance between quality and cost, with consumers carefully evaluating the price of obtaining specific functionalities.

That said, luxury and high-end consumption still hold allure. Despite declining sales figures for many luxury brands in mainland China starting from Q2, Chinese consumers remain a driving force in the global luxury market. Factors such as the reopening of international flights and the yen’s devaluation have fueled significant spending by Chinese travelers in Japan and Europe, with overseas luxury purchases in H1 2024 surpassing pre-pandemic 2019 levels.

Emotional Consumption Upgrade

Rising disposable incomes and heightened self-awareness are driving demand for mental health and emotional well-being, especially among younger consumers. By 2023, “emotional value” had already become a key metric for evaluating products and services, a trend that has continued into 2024 with greater segmentation. According to a youth consumption trends survey by Beike Finance, nearly 30 percent of respondents reported making purchases based on emotional value. Categories like sports, pets, and anime/comics/games (ACG) are expanding rapidly, catering to increasingly specific consumer needs.

Outdoor activities remain popular in sports consumption. Beyond well-known pursuits like skiing and cycling, niche hobbies such as long-distance backpacking, trail running, and high-altitude climbing are gaining traction. Outdoor enthusiasts view natural landscapes as an antidote to urban life, finding physical and emotional nourishment through self-challenge and connection with nature.

Pet ownership is another sector witnessing record-breaking spending. According to the 2025 White Paper on China’s Pet Industry by Paidu, the sector achieved a compound annual growth rate of 13.3 percent from 2015 to 2024. This surge correlates with societal changes like an aging population, declining marriage rates, and falling birth rates, with pets serving as emotional companions. For non-pet owners, watching cute animal videos provides a similar emotional boost, making such content a staple in their consumption habits.

Similarly, the rise of the “guzi economy” cannot be ignored. Derived from the word “goods,” “guzi” refers to ACG-related merchandise. In 2024, China’s guzi market reached 168.9 billion RMB, a 40 percent increase from 2023. This phenomenon has turned merchandise into a “spiritual staple” for ACG enthusiasts, as explored in Jingzhi Chronicle’s deep dive into this explosive trend.

Cultural Revival

The guochao (national tide) narrative cooled in 2024, giving way to a more rational and tangible appreciation for traditional Chinese culture and aesthetics. Young people are reevaluating and cherishing their cultural heritage, seeking to incorporate it into their daily lives. This shift influences not only consumption but also design, art, and marketing trends, gradually permeating societal values.

Local governments have actively organized cultural events, such as Yangshuo’s “Golden Dragon Parade” and Nanjing’s Qinhuai Lantern Festival, which attract tourists, bolster regional economies, and strengthen cultural identity. Brands, too, are delving deeper into regional traditions, drawing inspiration from minority cultures like Yi, Miao, and Li, as well as Chinese crafts like filigree inlay and bamboo carving.

Moreover, Chinese consumers increasingly lean toward natural, minimalist lifestyles. Urbanites are escaping fast-paced work environments to find solace in rural areas, while towns leverage natural resources and slower living paces to attract tourists. Green industries such as organic agriculture and artisanal production are flourishing, satisfying demands for healthier living and unique travel experiences.

Mysticism as “Medicine”

In 2024, mysticism emerged as a remedy for life’s uncertainties. Amid growing social pressures and economic challenges, feng shui, astrology, and tarot gained popularity, offering individuals a sense of control over chaotic circumstances. Mysticism has become a “tranquilizer” for many, normalizing “good luck rituals” as a coping mechanism.

This trend also presents marketing opportunities. Fashion and jewelry brands have long incorporated zodiac symbols and auspicious motifs into their product lines, benefiting from the emotional resonance these items provide. Such offerings meet not only material needs but also the psychological desire for personalized attention and solutions to life’s challenges.

Investing in long-term wellbeing

Underlying these trends is a growing emphasis on intangible fulfillment and personal growth. The 2024 McKinsey China Consumer Report identifies education, travel, food and beverages, and health-related products and services as the fastest-growing sectors in China’s consumer market. Consumers are willing to pay for long-term rewards or memorable experiences, even if immediate gratification is elusive.

This is particularly true among high-net-worth individuals. The 2024 Hurun Best of the Best report revealed that China’s high-end consumer market rebounded by 3 percent to 1.7 trillion RMB, driven by tourism, wellness services, and premium goods. High-net-worth individuals prioritize investments in gold, funds, and bank deposits over real estate, reflecting a strategic shift in financial preferences.

As China navigates 2024’s turbulence, the focus on domestic demand and high-quality development grows stronger. These evolving trends signal a pivotal moment for the nation’s consumer market, one laden with opportunities and challenges. For businesses, adaptability and a nuanced understanding of these shifts are essential to thriving in this complex landscape.