How China Reacts to Maria Grazia Chiuri’s Departure from Dior

By

Wenzhuo Wu

Published on

May 30, 2025

Jingzhi Curates is your daily compass for navigating the dynamic intersections of business, culture, and society. Each installment distills the day’s most pressing issues into thoughtful, actionable insights—perfect for leaders, innovators, and the intellectually curious. Whether a game-changing shift in global markets, a breakthrough in AI, or a cultural trend redefining consumer behavior, Jingzhi Curates delivers clarity in complexity.

Maria Grazia Chiuri, the first woman to ever lead Dior’s women’s collections, is stepping down after a nine-year tenure that saw the French maison soar to new commercial heights—particularly in markets like China, where her signature blend of feminist storytelling, inclusive silhouettes, and high craftsmanship struck a rare chord with modern luxury consumers.

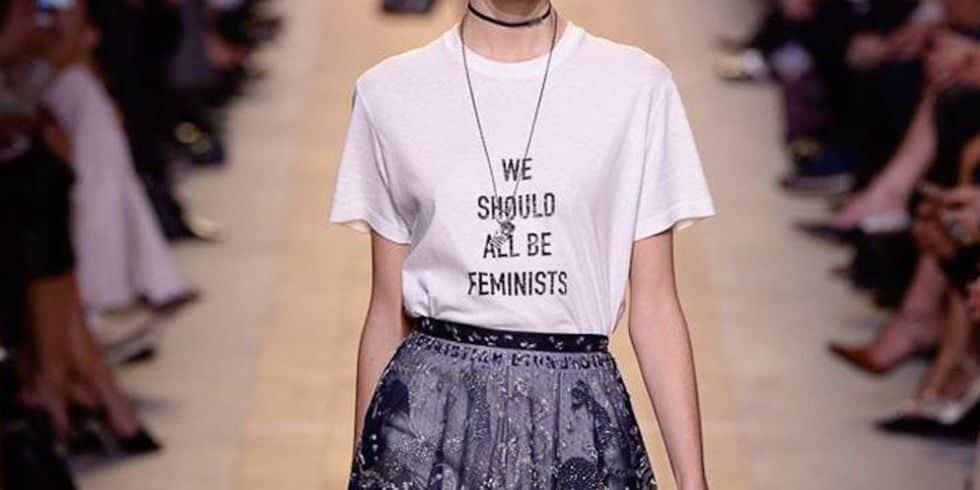

Chiuri’s legacy at Dior is more than just the visual codes she redefined—her now-iconic slogan tees (“We Should All Be Feminists”), Grecian draping, and reinterpretations of archival classics became emblems of a new kind of luxury: one that spoke to intellect, identity, and everyday elegance. Her leadership helped Dior’s ready-to-wear sector grow revenues nearly fourfold—from €2.2 billion in 2017 to an estimated €8.7 billion in 2024, according to HSBC. In a house historically known for its Bar jacket and extravagant femininity, Chiuri made space for pragmatism and purpose.

But the global luxury context is shifting—and so is Dior.

LVMH, Dior’s parent company, has posted cooling numbers in recent quarters, with organic sales in fashion and leather goods declining by 5 percent year-on-year in Q1 2025. Dior, once a consistent outperformer, now sits slightly below the segment average. Analysts and insiders alike point to signs of brand fatigue—especially in regions where consumers are reevaluating luxury’s meaning amid economic uncertainty.

A Polarized Response in China

Nowhere is this tension more apparent than in China. As news of Chiuri’s departure broke, social platforms like RedNote and Weibo lit up with divided reactions. Many retail professionals noted that Chiuri’s vision resonated strongly with Chinese women seeking refined yet wearable silhouettes—ones that cater to diverse body types and lifestyles. Her gentle feminism, often communicated through art collaborations and runway performances, also struck a chord with millennial and Gen Z consumers attuned to deeper values.

However, critiques have grown louder in recent seasons. “Too safe, too repetitive,” some users commented, referencing Dior’s ready-to-wear line-up. “Every season feels like a remix of the last.” Others questioned whether Chiuri’s vision, rooted in European feminist theory, fully translated to the nuances of Chinese womanhood and its evolving expressions.

Indeed, Chiuri’s so-called “feminist triangle”—comprising inclusive design, craftsmanship, and storytelling—has increasingly been tested by the volatility of the post-pandemic luxury landscape, where values-based branding must now coexist with intense demand for novelty and digital fluency.

The Jonathan Anderson Question

While Dior has not named a successor, all signs point to Jonathan Anderson, who joined Dior earlier this year as its new menswear designer. Known for his intellectual rigor and cult appeal at both JW Anderson and Loewe, Anderson could inject a more directional, art-infused edge into Dior’s next chapter.

For the China market, Anderson’s potential appointment presents both opportunity and risk. On one hand, his gender-fluid aesthetics and conceptual storytelling may resonate with younger luxury shoppers hungry for experimentation and niche codes. On the other, there’s a question of relatability: Can Anderson maintain the broad commercial appeal that Chiuri cultivated so precisely in China, especially among older or more conservative clientele?

The transition also arrives at a time when Chinese consumers are adopting a more selective, value-driven approach to luxury. As seen in Jingzhi Chronicle’s recent coverage of selective consumption recovery and the growing appeal of niche craftsmanship, storytelling alone may no longer be enough. Brands need to be culturally agile and product-smart—relevant across tiers, age groups, and psychographics.

What’s Next for Dior in China?

Dior’s challenge now is to balance its core pillars—elegance, innovation, and legacy—with a more multi-dimensional approach to Chinese consumer engagement. Chiuri’s era proved that a strong creative point of view, when paired with resonant cultural cues, can unlock immense value. The question is whether Dior’s next chapter, likely under Anderson’s stewardship, will continue that momentum or mark a sharp creative turn.

Whatever the case, one thing is clear: the Chinese market will remain the ultimate litmus test for Dior’s future relevance. In a landscape where luxury is increasingly defined by adaptability and emotional resonance, the house’s next move will be closely watched—not just in Paris, but in Chengdu, Shanghai, and beyond.