How Inbound Tourism Might Drive Retail Growth in China

By

Huiyan Chen

Published on

August 12, 2025

For years, China has been viewed through a narrow commercial lens: the world’s factory, and more recently, the world’s most voracious consumer market. But a new narrative is emerging—one shaped not by exports or domestic sales, but by inbound travelers. With policy shifts enabling easier access, and local brands offering retail experiences rich in cultural depth, China is positioning itself not just as a place to manufacture or consume—but as a place to shop with meaning. Could China become the world’s next retail pilgrimage site?

Inbound tourism has become a major keyword in China’s retail innovation and tourism market growth since last year, and its strong rebound this year suggests the momentum is more than a temporary spike. Data from platforms like Ctrip and YouTrip show that China has now overtaken Japan as the top outbound travel destination for tourists from South Korea and Singapore. Ctrip’s latest earnings report revealed that inbound tourism orders in Q1 2024 doubled year-on-year, and soared by 130% during the May Day holiday. This recovery is not only rapid but appears to have long-term potential.

“Inbound tourism in China could potentially generate an additional one to two trillion RMB in revenue,” noted Ctrip Co-founder and Executive Chairman James Liang in a recent public article. This projection isn’t baseless: currently, inbound tourism revenue accounts for only 0.5% of China’s GDP, compared to 1–2% in more mature tourism markets like Japan. Given the scale of China’s economy, even reaching the global average would unlock tremendous growth potential.

At the heart of this opportunity is retail consumption. According to Alipay, spending by inbound tourists during the first three days of the May holiday increased 180% year-on-year. Inbound visitors are not only revitalizing the cultural and tourism sectors—they’re poised to spark a broader consumer wave. Beyond iconic landmarks, the retail sector—especially fashion, beauty, and lifestyle—is becoming an increasingly vital point of cultural and emotional connection between visitors and destinations.

Compared with China’s well-known skyscrapers, scenic landscapes, and cuisine, the country’s consumer brands are still in search of true international influence. While the recent “go-global” trend has helped domestic brands shake off their old “low-cost” image, global distribution channels often fall short of conveying the full depth of Chinese brand stories and cultural context.

Now, with the world’s consumers stepping onto Chinese soil, local brands have a golden opportunity to capture their attention. Understanding and responding to these visitors’ expectations for local brand experiences has become an urgent task for both retailers and domestic labels. This shift reflects a broader strategic repositioning: China is no longer just selling products—it’s exporting cultural identity through retail.

Building Retail Infrastructure for Inbound Tourism

The growing appeal of inbound travel is driven by a steady stream of policy upgrades. On July 11, the Ministry of Foreign Affairs announced that China now offers unilateral visa-free entry to citizens of 47 countries and transit visa exemptions to travelers from 55 countries. In the first half of 2024, 13.64 million foreign visitors entered China on visa-free terms, accounting for over 70% of all inbound travelers—a year-on-year increase of nearly 54%.

To meet the demands of this rising tide of visitors, China has been accelerating infrastructure improvements aimed specifically at enhancing tourist shopping experiences.

In April, the Ministry of Commerce reduced the minimum purchase for duty-free rebates from 500 RMB to 200 RMB, raised the cap for cash refunds to 20,000 RMB, and rolled out a new “buy-and-refund instantly” policy nationwide. According to Hui Gao, Chief Representative for China at Tax Free World Association, “The combination of ‘instant tax refund’ and the 240-hour visa-free policy will significantly enhance China’s appeal as a global shopping destination.”

Payment systems are also evolving rapidly. Alipay now supports foreign tourists using major international cards like Visa and UnionPay International, and connects to 13 overseas e-wallets through its “foreign wallets for domestic use” model. “The synergy between instant tax refunds, visa-free access, and payment adaptation is forming a cycle of ‘spend—refund—respend,’ which helps translate the tourism boom into a consumption boom,” said Fang Sun, Deputy General Manager at China Duty Free Group (CDFG).

Meanwhile, the duty-free system—an essential feature of any global shopping hub—is also expanding. Led by CDFG, China’s duty-free retail network is evolving from isolated hubs into a fully integrated ecosystem, covering airports, downtown stores, cruise terminals, and border crossings. From flagship duty-free complexes in Sanya and Haikou to strategic rollouts at major airports in Beijing and Shanghai, the infrastructure is designed to reach international travelers throughout their journey.

However, some gaps remain. “Compared with the rapid progress in policies and infrastructure, services are still a major challenge—particularly in areas like payment guidance, language support, and continuity of the tourist experience,” Gao acknowledged.

From Products to Meaning: How to Make Culture ‘Consumable’?

Beyond logistics, brands and retailers are beginning to detect a shift in how tourists shop. Visitors are increasingly motivated by meaning rather than price—shopping has become a way to connect with culture.

“We’ve seen a notable shift from ‘price-driven’ consumption to a deeper appreciation for quality,” noted Nicolas Morineaux, CEO of Galeries Lafayette China. “As ‘Made in China’ gains global recognition in fields like technology, beauty, design, and lifestyle, international tourists are increasingly open to purchasing premium local products. The old stereotypes are fading, and in their place is a new confidence in Chinese innovation and craftsmanship. We’re also witnessing a shift from ‘shopping as sightseeing’ to ‘shopping as cultural immersion.’ Visitors want more than just transactions—they seek meaningful experiences.”

Shopping is being reintegrated into the travel experience—not just as a transactional activity, but as an entry point into understanding a city, and even a culture. This shift marks the rise of what we might call “cultural shopping.”

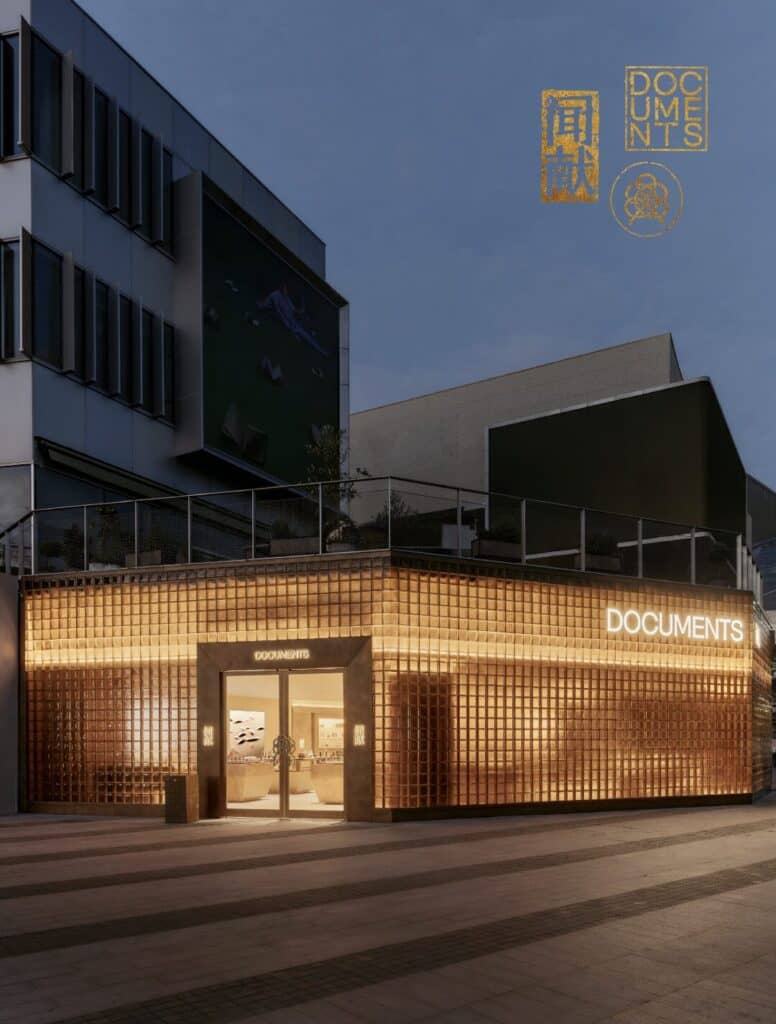

This creates a powerful opportunity for local brands to export culture and reshape identity. According to Zhaoran Meng, founder of fragrance house Documents, Chinese premium brands are uniquely well-positioned in this new wave of global tourism consumption. “When international visitors return to China, they’re not looking for bargains or substitutes,” he explained. “They’re seeking to experience a value system that differs from the Western luxury narrative—something emotionally resonant, something culturally rooted. And that’s exactly what homegrown Chinese brands can offer.”

Meng emphasized that this appeal is not about superficial marketing, but about authentic expression. “We’re not creating experiences to serve tourists,” he said. “We’re building a Chinese way of modern living that naturally resonates across cultures.”

The first touchpoint of cultural shopping often begins with the product itself. Brands that seamlessly blend traditional Chinese elements with contemporary design are becoming key pillars as retailers rethink their merchandising strategies. According to Morineaux, brands like Documents, To Summer, and Songmont resonate with international tourists precisely because they are “each rooted in Chinese tradition yet embracing a global design perspective. Their success demonstrates how the fusion of Chinese cultural heritage and modern aesthetics can unlock wide appeal.”

In other words, these products serve not only as practical travel souvenirs but also as cultural conduits. To Summer’s Yin travel-size fragrance set, for example, is designed for portability and gifting, while its Mascot Sachet embeds symbolic meaning through materiality and artisanal detail—offering a deeper connection to Chinese aesthetics and beliefs.

Spatial experience deepens this connection. “We hope our physical stores become destinations in themselves,” said Meng. “Spaces like our Longgong flagship in Shanghai or the Yuyuan Reading Room are not just places to shop—they’re sensorial narratives of Chinese scent culture. Through these experiences, we want to give international guests not just something to buy, but something to remember and take with them.”

As products and spaces work in tandem, Chinese brands are transforming in the eyes of global consumers—from functional items to cultural emissaries.

Zhaoran Meng sees “cultural shopping” as an evolution of consumer behavior: “Shopping has never been just a transaction. Today, people are no longer simply satisfying a functional need when they consume—they are exploring deeper and more diverse layers of meaning, whether it’s emotional connection, cultural resonance, or even affirming their personal identity.” He emphasized, “In this context, people are looking for brands with a soul—not the cheapest or the trendiest, but those that feel authentic, moving, and truly relatable.”

At the same time, retail platforms are repositioning these culture-rich brands at the forefront, rethinking both merchandise curation and spatial design to meet the expectations of a new generation of international visitors. “Over the past year, Galeries Lafayette has taken concrete steps in this direction by introducing more culturally grounded brands like Xixing Le, Man Song and MU16, and creating engaging, themed retail experiences through curated marketing and cross-disciplinary collaborations,” said Morineaux.

This kind of integration not only helps international visitors appreciate the distinctiveness of Chinese brands, but also empowers local brands to find their place within a global context.

When Retail Becomes Cultural Diplomacy

Embedding culture into the shopping experience—and weaving brand storytelling into deeper cultural narratives—is reshaping how the world sees China as a shopping destination. This transformation feeds directly into the momentum of inbound tourism, positioning retail as a bridge between commerce and cultural connection. Just as Chinese tourists flock to Paris for fashion, Tokyo for subcultures, and Seoul for K-lifestyle inspiration, China’s global shopping appeal must extend beyond commercial logic—it must be embedded in cultural texture and urban imagination.

If China’s 20th-century retail story was defined by scale and speed, its 21st-century chapter may well be defined by depth, design, and retail innovation. As local brands evolve into cultural storytellers, and visitor-friendly ecosystems fall into place, China is entering the global shopping map not just with new malls, but with new meaning. In the competition to capture the hearts and wallets of global travelers, cultural shopping may become China’s most powerful soft power export yet.

If culture can be carried home, it can travel the world.