Gucci Takes A Measured Approach for Demna’s First Collection

By

Anqi Wen

Published on

July 22, 2025

Gucci is taking the time to introduce its new creative director Demna.

On July 9, Demna staged his final haute couture show for Balenciaga in Paris. While many described it as “restrained,” “reverent,” or even “nostalgic,” the notably understated presentation seemed to mark a meaningful closing chapter in Demna’s near-decade-long era of radical aesthetics at the house.

Almost simultaneously, Demna indicated in an interview with British journalist Suzy Menkes that his debut collection, originally scheduled for this Fall, would be postponed until March 2026. For a brand that has gone through years of stylistic transition and narrative ambiguity, this decision was both unexpected and entirely understandable.

The surprise lies in how sharply it diverges from luxury fashion norms, where creative directors are typically expected to present collections immediately upon appointment. Not so this time around. Taking nearly a year to prepare a debut show could wreak havoc on the fashion calendar. Yet this disruption aligns with Demna’s signature approach: rejecting the tyranny of industry timelines and instead anchoring public attention with sharp, fully formed conceptual frameworks that allow the designer—not industry parameters—to define the brand’s message and cultural context.

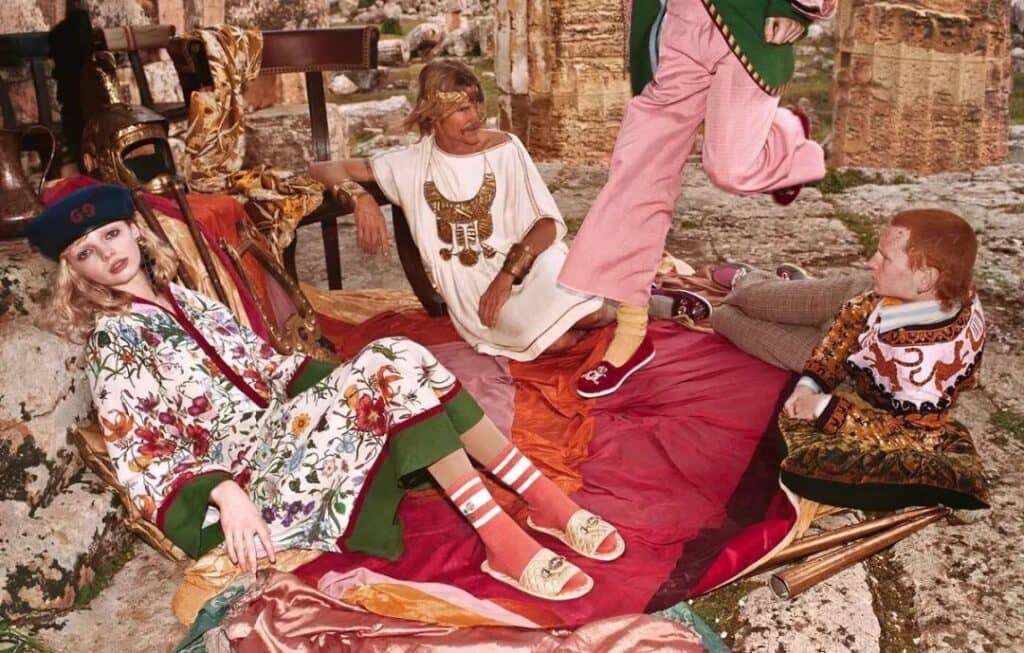

Looking back at his arrival at Balenciaga in 2015, Demna redefined the brand’s identity through unapologetically personal aesthetics, from oversized, armor-like shoulder pads to luxury handbags shaped like grocery bags and exaggerated sneakers. He brought irony, provocation, and political undertones into high fashion, shaking the codes of traditional elegance and restraint. With a string of controversial and conversation-driving releases, Balenciaga became one of the most talked-about luxury brands of the past decade, with Demna’s conceptual thinking taking a dominant role in brand strategy.

And yet, it was this very designer—renowned for his strong personal aesthetic and for shaping brand identities with a commanding hand—who, in the same interview with Ms. Menkes, stated: “I am going to do things that will remind people what Gucci is.”

While he confronted the zeitgeist at Balenciaga through aggressive provocation, his approach to Gucci is notably more measured.

Rather than signaling retreat, this subtle shift suggests a deliberate and strategic recalibration. In truth, Gucci has already cycled through multiple narrative identities, from Tom Ford’s sensual minimalism to Alessandro Michele’s romantic maximalism. For Demna, taking the time now to study the brand’s historical DNA may allow him to build a future vision that both honors Gucci’s legacy and reshapes it for a new era.

At the same time, Gucci urgently needs to rebuild market trust following ongoing commercial challenges. In 2024, the brand’s revenue fell to 7.65 billion euros, with profitability continuing to slide. According to the Lyst Index, Gucci tumbled to ninth spot from second in terms of the top ten most searched brands in Q1 of 2023, signaling a decline in popularity among Gen Z consumers. The brand has since fallen out of the top 10 and remains so as of Q1 2025.

In this context, what the brand needs is not merely another product launch, but a defining cultural reset.

From a group-level perspective, the show’s postponement also signals a strategic reallocation of attention and resources. On June 16, Kering Group appointed former Renault CEO Luca De Meo as its new CEO, who officially took office on July 15. As Kering’s revenue backbone, Gucci is likely to receive renewed investment focus, but will also bear greater pressure to perform.

Navigating the tension between Demna’s creative tempo and Kering’s business imperatives will be a critical lever in the group’s broader restructuring. How Gucci emerges from this moment could determine whether it regains cultural authority in the fashion world on its own, future-facing terms.

Within this context, Demna’s pause is also a form of creative negotiation. From Alexander McQueen, Virginie Viard at Chanel to Jonathan Anderson’s crucial role at Dior, designers across the spectrum face the same structural paradox: While internal brand strategies remain in flux, the market demands instant novelty and recognizability. This pressure turns systemic brand rebuilding into a burden of salvation.

Kering’s Q1 2025 earnings further exposed this structural challenge: Gucci’s revenue declined by 25% on a comparable basis, becoming a central drag on the group’s performance. Against this backdrop, Demna openly stated: “I need more than two months to build a vision.”

The subtext is clear: the brand’s future visual identity, cultural stance, and long-term trajectory cannot be rushed to meet seasonal deadlines. For Gucci, currently undergoing dual rebuilding of image and performance, deliberate restraint is more valuable than speed.

Looking ahead, Demna’s Gucci will not simply be an extension of his personal style, but a broader redefinition of luxury brands’ capacity for self-determination. This is not just a designer’s debut: It is a brand reconstruction from the inside out, and a fashion shift worth waiting for.