Rethinking Growth: The Beauty Industry in the Age of Transformation

By

Huiyan Chen

Published on

January 31, 2025

In 2024, “economic pressure” and “challenging conditions” were ubiquitous terms in financial reports, forcing global beauty giants to confront the reality of an industry winter—especially in China. According to the National Bureau of Statistics, November saw a 26.4 percent year-over-year decline in cosmetics retail sales, amounting to RMB 43.37 billion, with cumulative retail sales falling 1.3 percent to RMB 401.46 billion.

International brands bore the brunt of the slowdown. L’Oréal reported a global 2024 sales increase of just 5.6 percent, while its North Asia market declined by 3.2 percent. Estée Lauder’s net sales declined by 6 percent in Q2, with the Asia-Pacific region, including China, recording an 11 percent year-on-year drop. Meanwhile, Japanese and Korean conglomerates such as Shiseido and Amorepacific also struggled, with Shiseido’s BAUM and L’Oréal’s TAKAMI exiting the Chinese market—an unmistakable sign of escalating competition.

But as international brands faltered, local players continued to seize the moment. In 2023, domestic beauty brands nabbed over half the market and extended that dominance in 2024 with further growth. Proya, for instance, recorded a 32.72 percent revenue increase in the first three quarters, reaching RMB 6.97 billion, with net profits rising 33.95 percent to RMB 999 million, putting the brand on track to surpass RMB 10 billion in annual revenue.

Science-Backed Skincare: The Ingredient Race Intensifies

As Chinese consumers become increasingly knowledgeable about skincare, the rise of “ingredient-conscious” buyers is reshaping the market. This heightened awareness has fueled the demand for efficacy-driven skincare, making 2024 another banner year for science-backed formulations.

A report by the Chinese Academy of Sciences found that nearly 95 percent of consumers prioritize “scientific and safe ingredient formulations,” while roughly 75 percent emphasize the importance of evidence-backed results. Similarly, Tmall Beauty’s Tech-Driven Skincare Trend Report indicates that products featuring advanced scientific ingredients account for approximately 48 percent of China’s skincare market.

This data signals a shift toward more rational consumer behavior, compelling domestic brands to invest heavily in R&D. In 2024 alone, 11 Chinese beauty companies—including Shanghai Jahwa, Bloomage Biotech, Voolga, and Botanee—filed for 23 new ingredient registrations with China’s National Medical Products Administration. As local brands elevate their research capabilities, China’s beauty industry is no longer just following global trends but actively shaping them.

Blurring the Lines: Beauty Meets Medical Aesthetics

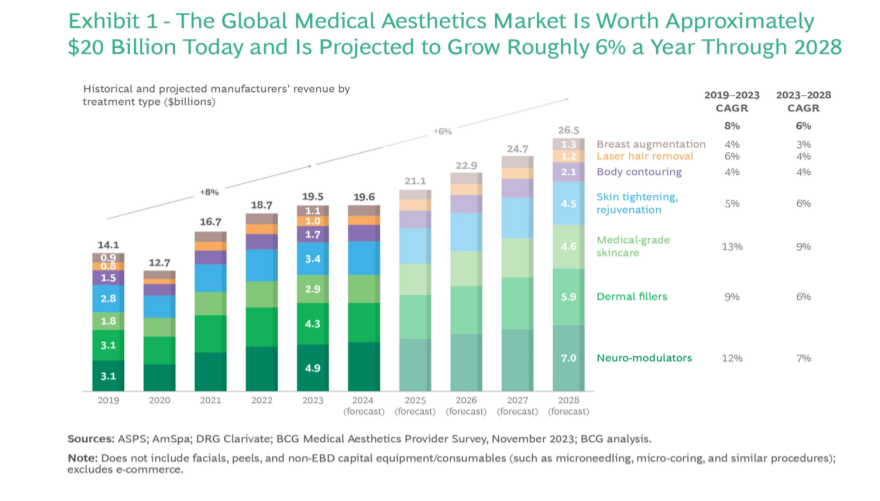

With efficacy at the forefront of consumer demand, medical aesthetics is increasingly considered the ultimate skincare solution. The phrase “skincare ends with medical aesthetics” has become a popular refrain, reflecting a clear shift in spending priorities: Rather than investing in elaborate skincare routines, many consumers are opting for high-impact cosmetic procedures.

According to the 2023 China Medical Aesthetics Industry Report, China’s medical aesthetics market surpassed RMB 200 billion in 2023, growing at a 20 percent annual rate, with projected compound growth of 15 percent per year over the next four years.

This shift has forced beauty brands to rethink their strategies, leading to the rise of “post-treatment repair” skincare and medical-grade products. In 2024, international brands such as SkinCeuticals, Mentholatum, and Clinique launched specialized medical-grade skincare lines, while domestic powerhouses like Bloomage Biotech, Vlooga, and Botanee continued to strengthen their foothold in this sector.

Practical Consumption: Buy Less, Buy Smarter

As consumerism cools, minimalism is becoming the new norm in beauty. “Buy less, buy smarter” is the defining mindset shaping purchasing habits.

On social media platform RedNote, searches for “minimalist skincare” and “lazy skincare” have reached 9.16 million. Consumers are increasingly simplifying their routines, prioritizing essentials over excess. This trend extends beyond skincare into makeup, where products like all-in-one palettes and multi-use creams are gaining traction. RedNote’s 2024 Makeup Industry Trend Report revealed that searches for “lip & cheek dual-use” products surged by 130,940 percent in the first half of the year.

This shift highlights a growing preference for efficiency and practicality, challenging brands to innovate multipurpose products that align with the evolving needs of consumers.

Emotional Beauty: The Rise of Sensory Self-Care

While consumers are cutting back on facial skincare, they are investing more in body and hair care, turning everyday routines into wellness rituals.

The Boston Consulting Group study found that 30 percent of consumers increased their use of body care products in 2024, while 40 percent now use five or more hair care products daily. This trend reflects the growing influence of the “healing economy,” where bath and hair care products are no longer mere essentials but tools for emotional well-being.

On RedNote, searches related to “bath therapy” have exceeded 1.3 million. Meanwhile, “hair care” content has reached an astounding 100 million searches, underscoring the expanding role of self-care in consumer lifestyles.

Luxury bath and hair brands have benefited from this shift, with niche labels gaining traction in China’s market. As daily routines become more ritualistic, brands have an opportunity to develop products that not only serve functional needs but also cater to emotional well-being.

Fragrance Boom: A Market Rethink

Since the pandemic, “fragrance economics” has overtaken the “lipstick effect,” with Chinese consumers viewing scent as a means of self-expression and emotional uplift.

Frost & Sullivan projects that China’s fragrance market will reach RMB 44 billion by 2028, with a compound annual growth rate of 14 percent from 2023 to 2028. Despite this rapid expansion, fragrance penetration in China remains at just 5 percent—a figure that has attracted a flood of new entrants.

The influx has led to a milestone year for niche perfume brands. In 2024, USHOPAL invested in To Summer, L’Oréal acquired a minority stake in Documents, and Melt Season became the first Chinese fragrance brand to enter DFS luxury travel retail.

However, as “oriental fragrance” narratives and experiential store concepts saturate the market, competition is intensifying. Maintaining consumer engagement beyond novelty will be the next challenge.

Short-Drama Marketing: Emotional Storytelling as a Sales Driver

In 2024, short-drama marketing became one of the most effective ways to forge emotional connections with consumers.

Chinese beauty brand Kans pioneered the trend in 2023, partnering with top Douyin drama creator Jiang Shiqi to launch a customized short series. Within a month of release, the campaign generated over RMB 100 million in GMV and topped brand live-streaming rankings. This success has since drawn global beauty giants—including Helena Rubinstein, SK-II, Estée Lauder, L’Oréal, and La Mer—into the short-drama marketing space. For example, at the start of 2024, Helena Rubinstein collaborated with Douyin influencer @JiangShiqi to launch a short drama series, driving the brand to generate over RMB 1.1 billion in GMV and claim the top spot on Douyin’s luxury beauty sales ranking for the first half of the year.

As more brands enter this arena, differentiation will be key. Beyond creating emotionally resonant narratives, companies must explore sustainable content strategies to avoid the diminishing returns of repetitive storytelling.